These Factors Could Lead to Upside to CLF’s Free Cash Flow

Cleveland-Cliffs (CLF) had accumulated debt over a number of years.

Jan. 19 2018, Updated 7:30 a.m. ET

Free cash flow

Cleveland-Cliffs (CLF) had accumulated debt over a number of years. Moreover, its debt exceeded its earning ability, which left almost no room for growth. This was concerning for investors. These concerns are mostly in the background now, as the company has taken care of a major part of its debt and has started focusing on growth. In this context, we’ll discuss Cleveland-Cliffs’ ability to generate FCF (free cash flow).

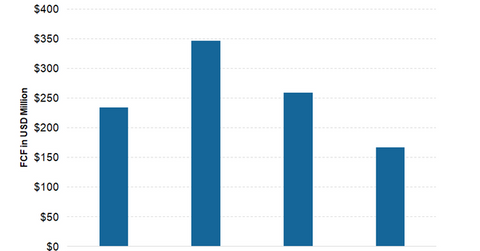

FCF generation

In its 4Q16 earnings call, Cleveland-Cliffs’ management noted that it expects to generate FCF of $550 million in 2017. Things have, however, changed since then. The company reduced its EBITDA (earnings before interest, tax, depreciation, and amortization) guidance twice in 2017. The current analyst consensus for Cliffs is FCF generation of $293.5 million in 2017, which implies growth of 25.5% year-over-year (or YoY).

Due to expectations of reduced volumes and profitability, the estimates for FCF have also come down. After CLF’s 1Q17 results, analysts were expecting FCF of $500 million, which reduced to $346 million after its two downgrades. Since 3Q17, the estimate has further reduced to the current $293.5 million.

Is there upside ahead?

While the company had reduced its guidance for 2017, it is still optimistic about the demand pick-up and import restriction in 2018. If these catalysts materialize, the company could see a significant pick-up in the FCF going forward.

Cleveland-Cliffs’ debt maturities are still comfortable with major debt repayments now pushed to 2025. Among its peers (XME), BHP (BHP) (BBL) and Rio Tinto (RIO) have relatively comfortable maturity profiles, while Vale (VALE) could face some pressure on this front if iron ore prices remain low.