Tyson Foods Raises Fiscal 2017 Guidance

Tyson Foods (TSN) stock jumped about 8% on September 29, 2017, after the company raised its fiscal 2017 EPS (earnings per share) guidance.

Oct. 2 2017, Updated 12:25 p.m. ET

Guidance lifted

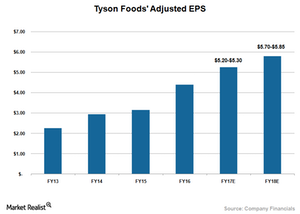

Tyson Foods (TSN) stock jumped about 8% on September 29, 2017, after the company raised its fiscal 2017 EPS (earnings per share) guidance. Tyson Foods’ management now expects fiscal 2017 earnings to be in the range of $5.20 to $5.30 per share, up from its earlier forecast of $4.95 to $5.05. Increased demand and cost savings are likely to drive the company’s profitability. Analysts expected the company to report adjusted EPS of $5.11 in fiscal 2017.

Meanwhile, management expects favorable market conditions to continue to boost its financials in fiscal 2018 and projects its bottom line to be in the range of $5.70 to $5.85, reflecting growth of 8% to 13% YoY (year-over-year).

Factors behind strong bottom-line growth

The graph shows that Tyson Foods has been growing its bottom line at a rapid rate thanks to its stellar sales performance. The company has been witnessing higher volumes driven by increased demand for high protein foods. Meanwhile, benefits from cost savings further supplement its EPS growth rate.

As for fiscal 2017, management is projecting that better-than-expected earnings for its beef segment will drive its bottom-line growth. Meanwhile, the company’s focus on controlling costs and driving efficiency will further support its bottom-line growth.

Tyson Foods expects to generate cost savings of $200 million, $400 million, and $600 million in fiscal 2018, 2019, and 2020, respectively, through reinventing its supply-chain and procurement process and lowering its overhead costs. Meanwhile, to streamline its management, the company announced that it would eliminate 450 jobs from its corporate offices in Chicago, Springdale, and Cincinnati.

In comparison, the company’s peers including Kraft Heinz (KHC), Conagra Brands (CAG), and Kellogg (K) are also expected to report improved EPS. However, the rate of growth is projected to remain low when compared with Tyson Foods as the tepid top-line performance could remain a drag.

Besides lower sales, increased input costs are taking a toll on the profitability of these companies. For instance, J.M. Smucker (SJM) and General Mills’ (GIS) profitability took a hit from higher input costs and declining volumes.