A Brief Analysis of Silver Miners in January 2018

The target prices of the four miners we’re covering in this part are higher than their current trading prices, which could lead to an optimistic outlook on their prices.

Jan. 11 2018, Updated 10:40 a.m. ET

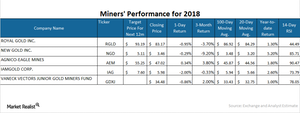

Miners’ performances

In this part of the series, we’ll scrutinize the technical details of silver mining shares. We’ve chosen First Majestic Silver (AG), Wheaton Precious Metals (SLW), Coeur Mining (CDE), and Hecla Mining (HL) for analysis. Among these four silver miners, AG, CDE, and HL have risen 0.30%, 2.3%, and 1.8%, respectively. SLW has fallen 4.9%. The Global X Silver Miners ETF, which tracks the performances of significant silver miners, has seen a marginal fall of 0.43%.

Moving averages

AG and SLW are trading below their shorter-term 20-day moving averages. CDE and HL are trading above their shorter-term 20-day moving averages, but they’re above their 100-day moving averages. SLW is above its longer-term 100-day moving average.

When a stock is trading reasonably below its 20-day and 100-day moving averages, that could mean a potential rebound in prices. These stocks are currently trading significantly above their 20-day and 100-day moving averages, which could indicate a possible decline.

The target prices of all these four miners are higher than their current trading prices, which could lead to an optimistic outlook on their prices.

Relative strength index

AG, SLW, CDE, and HL had RSI (relative strength index) scores of 33.9, 34.4, 5.0, and 55.6, respectively, as of January 9, 2018. The RSI levels have decreased due to the fall in precious metals.

When an RSI level is above 70, it indicates a probable price fall. If an RSI level is below 30, it indicates a possible rise in price. The RSI level for the Global X Silver Miners (SIL) is 62.1.