Analyst Recommendations for Varian Medical Systems before 1Q18

Varian Medical Systems (VAR) will announce its 1Q18 earnings results on January 24, 2018. It wants to establish itself as the leading cancer management company in the world.

Nov. 20 2020, Updated 1:09 p.m. ET

Analyst recommendations

Varian Medical Systems (VAR) will announce its 1Q18 earnings results on January 24, 2018. In January 2017, the company spun off its imaging components business into Varex Imaging (VREX). It has since been focusing on its core capabilities and has been taking initiatives and implementing strategic plans to establish itself as the leading cancer management company in the world. Read How Is Varian Positioned for 2018 after 2017 Transformation? for a detailed discussion on Varian’s future growth plans and market position. In this part of the series, let’s take a look at analyst recommendations for VAR stock for the next 12 months.

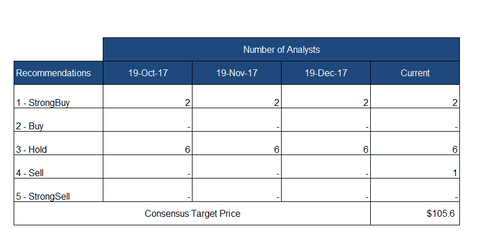

According to a recent survey by Reuters of nine investment research companies, VAR stock is rated a “hold” by six of the nine analysts. Two analysts have given the stock a “buy” rating, and one has rated it a “sell.” The chart above shows the 12-month recommendation summary on VAR stock.

Target prices

As of January 19, 2018, Wall Street analysts’ consensus 12-month target price for Varian Medical Systems is $105.63, which represents a downside risk potential of -3.6% on an investment in VAR stock for the next 12 months.

As of January 19, 2018, Varian Medical Systems’ major competitors, Intuitive Surgical (ISRG), Accuray (ARAY), and Boston Scientific (BSX), have average analyst target prices of $409.20, $6.80, and $31.10, respectively. These prices represent returns of -5.3%, 27.1%, and 13.3%, respectively, over the next 12 months.

Recommendation revisions and updates

On January 3, 2018, Evercore ISI assumed coverage of Varian Medical Systems with an “underperform” rating and a price target of $100 per share. On November 30, 2017, the Royal Bank of Canada provided a “hold” rating for VAR stock. It has a price target of $105 on the stock.

For exposure to Varian Medical Systems and in order to avoid the company-specific risks, investors could consider the Vanguard Mid-Cap ETF (VO). VO holds 0.25% of its total portfolio holdings in VAR stock.