A Quick Look at Miners’ Recent Performance

Precious metal miners saw mixed performance on Tuesday, November 14. Gold and silver saw an up-day while platinum and palladium were low.

Nov. 16 2017, Updated 9:02 a.m. ET

Miners in the doldrums

Precious metal miners saw a mixed performance on Tuesday, November 14. Gold and silver saw an up-day while platinum and palladium were low. We’ll compare the performances of four crucial silver miners, including First Majestic Silver (AG), Silver Wheaton (SLW), Coeur Mining (CDE), and Hecla Mining (HL).

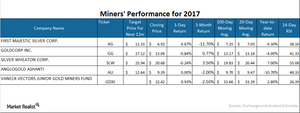

Almost all four miners that we’re discussing have seen a year-to-date or YTD loss. AG, CDE, and HL have a YTD loss of 15.3%, 22%, and 28%, respectively, while SLW manages saw a YTD gain of 6.2%. The Global X Silver Miners (SIL) saw a YTD loss of 5.1%.

Moving averages

All four miners are trading below their shorter-term, 20-day average. They’re also trading below their longer-term 100-day moving averages except for First Majestic. A huge discount below the 20-day and 100-day moving averages suggests a possible revival in prices while a premium suggests a likely fall.

The target prices of these four mining stocks remain higher than their current trading prices, which indicates that there could be a price rise.

RSI indicator

AG, SLW, CDE, and HL have RSI levels of 41.6, 48.9, 20.4, and 13.4, respectively. An RSI below 30 indicates a potential upward movement in price while an RSI above 70 indicates a possible downturn in price. SIL’s RSI level is 26.6.