Analyzing Top Utilities’ Current Valuations

The steep fall in utilities in the last couple of weeks seems to have aggravated utilities due to their record high valuations.

Dec. 29 2017, Updated 12:30 p.m. ET

Valuation

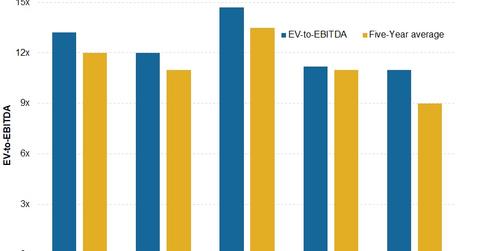

The steep fall in utilities in the last couple of weeks seems to have aggravated utilities due to their record high valuations. Broader utilities are currently trading at an average EV-to-EBITDA (enterprise value to earnings before interest, tax, depreciation, and amortization) multiple of 11x, while they’ve historically traded at ~8x–9x.

In comparison, NextEra Energy (NEE), the utility stock with the highest weight in the S&P 500 Utilities Index (XLU), is trading at a valuation multiple of over 13x. Its five-year historical average EV-to-EBITDA multiple is near 12x. Duke Energy (DUK) is also trading at a significant premium to its historical average. Its current valuation is 12x, while its five-year average is 11x.

Dominion Energy stock seems to be trading at a hefty premium compared to its peers. It’s presently trading at an EV-to-EBITDA multiple of 14.4x. Its historical valuation average is below 14x. Southern Company (SO) stock seems to be trading at a fair valuation compared to its peers. Its valuation multiple is near 11.2x, whereas its historical valuation multiple is ~11x.

Price-to-earnings multiple

US utilities have historically traded at a price-to-earnings (or PE) multiple of ~14x–15x, and they’re currently trading at a PE multiple of over 20x. NextEra Energy has a PE multiple of near 18x, and Duke Energy is trading at a PE multiple of 21x. Dominion Energy has a PE multiple of nearly 22x.

US utility stocks have corrected more than 7% in the last couple of weeks as the broader markets have continued to surge ahead.

Let’s move forward and dig into these utilities’ financials by having a look at their profit margins.