What’s Driving Wendy’s Stock Price

In this series, we’ll look at analysts’ earnings and revenue estimates for the next four quarters. We’ll also review Wendy’s valuation and analysts’ recommendations.

Jan. 4 2018, Published 12:44 p.m. ET

Stock performance

On December 29, 2017, Wendy’s (WEN) was trading at $16.42, which represents 11.4% growth since the announcement of its 3Q17 earnings on November 8, 2107.

In 3Q17, Wendy’s posted adjusted EPS (earnings per share) of $0.09 on revenue of $308.0 million. Analysts had forecast EPS of $0.12 on revenue of $310.3 million. Despite posting lower-than-expected 3Q17 earnings, Wendy’s stock rose due to the acquisition of Buffalo Wild Wings by Arby’s, of which Wendy’s owns ~18%. Arby’s acquired Buffalo Wild Wings for $2.4 billion on November 27, 2017.

Also, the announcement of Wendy’s new partnership with DoorDash to provide delivery service and the expectation of lower corporate taxes due to US tax reform appear to have increased investors’ confidence, leading to a rise in the company’s stock price.

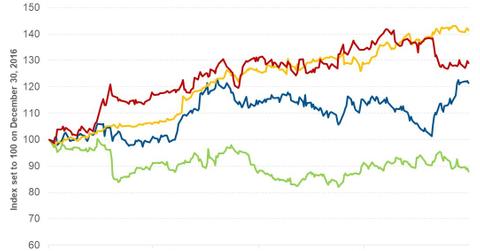

Year-to-date performance

Last year was a good one for Wendy’s, with its stock price rising 21.5%. During the same period, peers McDonald’s (MCD) and Restaurant Brands International (QSR) rose 41.4% and 29.0%, respectively, and Jack in the Box (JACK) fell 12.1%. The S&P 500 (SPX) and the iShares US Consumer Services ETF (IYC) rose 19.4% and 18.7%, respectively. IYC has invested 11.7% of its holdings in restaurant and travel companies.

Series overview

In this series, we’ll look at analysts’ earnings and revenue estimates for the next four quarters. We’ll also review Wendy’s valuation and analysts’ recommendations. Let’s start by looking at analysts’ revenue expectations.