What’s Driving DMLP’s Correlation with Natural Gas?

Dorchester Minerals (DMLP), a royalty interest owner MLP, is in third place in terms of its correlation with natural gas.

Dec. 1 2017, Updated 11:20 a.m. ET

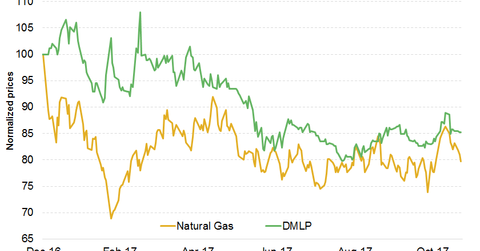

DMLP versus natural gas

Dorchester Minerals (DMLP), a royalty interest owner MLP, is in third place in terms of its correlation with natural gas. DMLP’s three-month correlation with natural gas was 0.32 as of November 27, 2017. However, the one-year correlation between DMLP and natural gas is close to zero.

Impact of natural gas volatility on DMLP’s earnings

DMLP has direct exposure to crude oil and natural gas prices through its mineral and royalty interest business. DMLP has a lower three-month correlation with crude oil compared to natural gas. The volatility in natural gas price has a direct impact on DMLP’s earnings, which in turn affects the partnership’s stock performance. Natural gas formed 51% of the partnership’s total oil and gas reserves. Moreover, the partnership hasn’t entered into hedging activity to lower its commodity price exposure.

In the next article, we’ll look into the correlation between Legacy Reserves (LGCY) and natural gas.