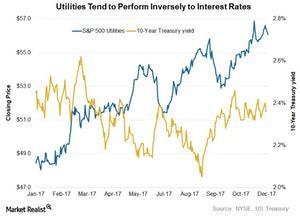

Utilities Tend to Have Inverse Relationship with Interest Rates

On December 13, 2017, ten-year Treasury yields fell to 2.4%. The ten-year Treasury yields (TLT) reported a yearly high of 2.6% prior to the first rate hike in March 2017.

Dec. 14 2017, Updated 12:59 p.m. ET

Utilities versus Treasury yields

On December 13, 2017, ten-year Treasury yields fell to 2.4%. The ten-year Treasury yields (TLT) reported a yearly high of 2.6% prior to the first rate hike in March 2017. Utility stocks are seen as bond proxies due to their stable dividend payments. Higher interest rates could make utilities less attractive relative to bonds, so we generally see investors selling utility stocks and switching to bonds—in order to obtain higher yields—when the rates rise.

Higher interest rates are unfavorable to utilities (XLU) (IDU) also because they carry huge piles of debt on their books. Thus, higher rates increase their debt servicing costs, ultimately dampening utilities’ profitability.

Let’s move ahead and see where utilities might go in the near future.