US Crude Oil Could Hold the $57 Level This Week

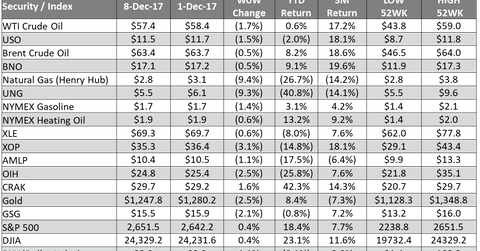

On December 1–8, 2017, US crude oil (USO) (USL) January futures fell 1.7%. On December 8, 2017, US crude oil January futures settled at $57.36 per barrel.

Nov. 20 2020, Updated 2:07 p.m. ET

US crude oil

On December 1–8, 2017, US crude oil (USO) (USL) January futures fell 1.7%. On December 8, 2017, US crude oil January futures settled at $57.36 per barrel.

In the seven calendar days to December 8, 2017, the US oil rig count rose by two to 751. The oil rig count rose for the third consecutive week. A higher oil rig count is an imminent threat to oil prices. US crude oil production could see more upside. US crude oil production is above 9.7 MMbpd (million barrels per day), according to recent weekly data—a new record high.

China’s crude oil imports were 9 MMbpd in November 2017—1.7 MMbpd more than the previous month. The rise in Chinese demand was 0.1 MMbpd less than the total pledged production cut by OPEC members and non-OPEC participating members. It could be a bullish factor for oil prices. It might help US crude oil hold the $57 level.

On December 1–8, 2017, the S&P 500 Index (SPY) and the Dow Jones Industrial Average Index (DIA) rose 0.4%.

Natural gas

On December 1–8, 2017, natural gas January 2018 futures fell 9.4%. On December 8, 2017, natural gas futures settled at $2.77 per MMBtu. Bearish natural gas inventory data could be behind this fall. However, the weather forecast suggests cooler weather, which might increase natural gas prices this week.