A Quick Look at the Performance of Silver Miners in December 2017

Coeur Mining and Hecla Mining have seen a loss in their prices on a year-to-date basis, falling 17.9% and 24.0%, respectively.

Dec. 26 2017, Published 12:40 p.m. ET

Silver mining stocks

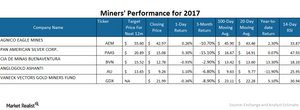

In this article, we’ll look at the performance of silver mining companies First Majestic Silver (AG), Silver Wheaton Precious Metals (SLW), Coeur Mining (CDE), and Hecla Mining (HL).

Among these four silver miners, Coeur Mining and Hecla Mining have seen a loss in their prices on a year-to-date (or YTD) basis, falling 17.9% and 24.0%, respectively. First Majestic and Silver Wheaton Precious Metals have risen 2.4% and 14.3%, respectively, on a YTD basis.

The Global X Silver Miners ETF (SIL) reported a marginal YTD loss of 0.78% despite the recent revival in silver.

Moving averages

AG and SLW are trading above their 20-day and 100-day moving averages. CDE and HL are trading above their 20-day moving averages but below their 100-day moving averages.

A stock trading reasonably below its 20-day and 100-day moving averages could suggest a potential revival in prices. Trading at a considerable premium to these averages could suggest a price decline.

Relative strength index

AG, SLW, CDE, and HL have RSI (relative strength index) scores of 75.5, 75.3, 46.3, and 64.0, respectively. These RSI levels have significantly increased over the past few days due to the revival reported by precious metals and mining companies.

An RSI score greater than 30 indicates a potential rise in prices, and an RSI score greater than 70 suggests a possible fall in prices. The Global X Silver Miners ETF (SIL) has an RSI level of 57.9.