Analysts’ Recommendations and Target Price for PPG Industries

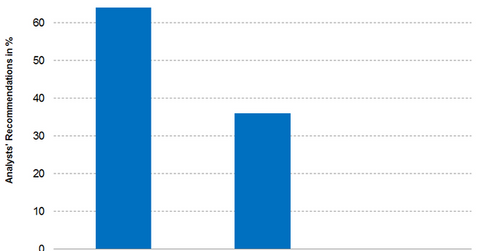

As of March 1, 2017, 22 brokerage firms were actively tracking PPG Industries (PPG) stock. About 64.0% of them have recommended a “buy” for the stock.

March 2 2017, Updated 1:05 p.m. ET

Analysts’ recommendations for PPG Industries

As of March 1, 2017, 22 brokerage firms were actively tracking PPG Industries (PPG) stock. About 64.0% of them have recommended a “buy” for the stock, and 36.0% have recommended a “hold.” None of the analysts have recommended a “sell.”

The analysts’ consensus for PPG’s 12-month target price is $110.43. That implies a return potential of 6.9% from its closing price of $103.29 on March 1, 2017.

Why many analysts are recommending a ‘buy’

PPG Industries has announced a new cost restructuring program with an aim to save $125.0 million in annual costs. PPG is also expected to use $2.5 billion–$3.5 billion in cash for acquisitions and share repurchases between 2017 and 2018. That could increase its revenue and earnings in the upcoming years. It also could have influenced analysts to recommend a “buy” for PPG stock.

Recommendations and price targets

Below are some of the recommended target prices for PPG Industries from some well known brokerage firms:

- On February 14, 2017, Evercore Partners (EVR) rated PPG Industries a “buy” with a target price of $117. That implies a 12-month potential return of 13.3% from its closing price of $103.29 on March 1, 2017.

- On January 23, 2017, JPMorgan Chase (JPM) announced a target price of $105 for PPG Industries. That implies a 12-month potential return of 1.7% from its closing price of $103.29 on March 1, 2017.

- On January 20, 2017, Goldman Sachs (GS) gave PPG Industries a “neutral” rating with a target price of $102. That implies a 12-month potential return of -1.3% from its closing price of $103.29 on March 1, 2017.

You can indirectly hold PPG industries by investing in the Vanguard Materials ETF (VAW), which has invested 3.3% of its portfolio in PPG Industries. One of the fund’s top holdings is Dow Chemical (DOW) with a weight of 8.6% as of March 1, 2017.

In the next and final part of this series, we’ll look at the latest valuations for PPG Industries.