Miners: Analyzing Core Indicators for Investors

A brief analysis of mining stocks is crucial when investors are parking their money in the precious metals market, specifically in mining companies.

Dec. 21 2017, Updated 9:15 a.m. ET

Mining stock analysis

A brief analysis of mining stocks is crucial when investors are parking their money in the precious metals market, specifically in mining companies.

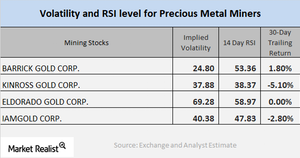

In this part, we’ll take a look at Franco-Nevada (FNV), Barrick Gold (ABX), Hecla Mining (HL), and Harmony Gold (HMY). We’ll also discuss the companies’ call-implied volatilities and RSI (relative strength index) scores.

Volatility analysis

Franco-Nevada, Barrick Gold, Hecla Mining, and Harmony Gold have call-implied volatilities of 23.8%, 24.8%, 46.7%, and 47.9%, respectively. Among these four miners, only Franco-Nevada has trailing 30-day losses of 9.6% and 6%, respectively. Barrick Gold and Hecla Mining have a trailing 30-day gain of 1.3% and 1.8%.

Relative strength index

If a stock’s RSI score is higher than 70, it could be overbought and its price could fall. If a stock’s RSI score is lower than 30, it could be oversold and its price could rise.

Franco-Nevada, Barrick Gold, Hecla Mining, and Harmony Gold have RSI scores of 19.6, 55.1, 63.1, and 41.1, respectively.

The Global X Silver Miners (SIL) and the iShares MSCI Global Gold Min (RING) saw downward movement in their price on December 19. They fell 0.66% and 0.39%, respectively.