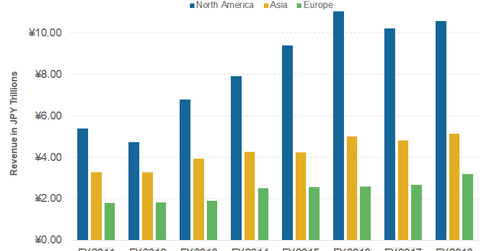

A Look at Toyota’s Fiscal 2018 Revenue from North America

Toyota Motor’s (TM) vehicle sales in North America fell 1.1% YoY (year-over-year) to 2.8 million units in fiscal 2018.

May 17 2018, Updated 4:55 p.m. ET

Higher revenue from North America

Toyota Motor’s (TM) vehicle sales in North America fell 1.1% YoY (year-over-year) to 2.8 million units in fiscal 2018. In spite of this drop in sales volumes, the company’s revenue from the region rose to 10.6 trillion Japanese yen in fiscal 2018, ~3.3% higher than in fiscal 2017.

Now, let’s take a closer look at Toyota’s performance in North America in its last fiscal year.

Demand for trucks and SUVs

In the last three consecutive years, the US demand for trucks and SUVs (sport-utility vehicle) has surged while the demand for small cars has fallen. This higher demand for SUVs and trucks also continued to benefit Toyota in North America.

In the SUV category, the demand for Toyota’s SUV models such as the RAV4 and Lexus NX was stable in North America. Also, the company’s popular trucks, the Tundra and Tacoma, continued to have a positive impact on its US sales and North American revenue. At the same time, its North American revenue in fiscal 2018 was boosted by a stronger US dollar compared to the yen.

In the last few years, other major automakers (VCR) General Motors (GM), Ford Motor Company (F), and Fiat Chrysler Automobiles (FCAU) have also benefited from stronger demand for their trucks. This ongoing trend in US auto sales has helped these companies improve their profitabilities because heavyweight vehicles tend to have higher margins than other small vehicles.

Sales in Europe and Asia

In Europe, the company’s vehicle sales rose 4.6% YoY (year-over-year) in fiscal 2018 to 0.97 million units. Similarly, in Asia (excluding Japan), Toyota’s vehicle sales rose 3.3% YoY to 1.39 million in its last fiscal year compared to 1.35 million in fiscal 2017.

Read on to the next article to learn about how Toyota’s margins fared in fiscal 2018.