Inside the Profit Margins of the 4 Biggest Gaming Companies

Analysts expect Activision to post a net margin of 14.4% in fiscal 2017, 16.9% in fiscal 2018, and 19.5% in fiscal 2019.

Dec. 5 2017, Updated 2:55 p.m. ET

Activision

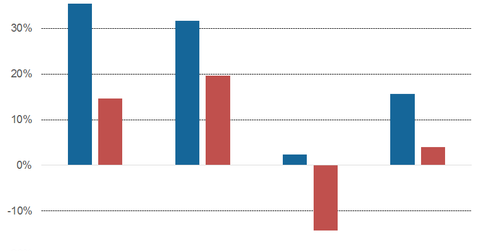

Gaming companies have seen a rise in profitability over the past two years, driven by a substantial increase in digital revenues. Activision Blizzard (ATVI) had an operating margin of 35.4% in fiscal 2016, with a net margin of 14.6%.

Analysts expect Activision to post a net margin of 14.4% in fiscal 2017, 16.9% in fiscal 2018, and 19.5% in fiscal 2019. Its operating margin could reach 34.3% in 2017, 37% in 2018, and 38.6% in 2019.

Electronic Arts

Electronic Arts (EA) had an operating margin of 31.7% in fiscal 2017, with a net margin of 19.6%. Analysts expect EA to post a net margin of 22.8% in fiscal 2018, 23.1% in fiscal 2019, and 23.8% in fiscal 2020. Its operating margin could reach 32.6% in 2018, 35.3% in 2019, and 37.5% in 2020.

Take-Two Interactive

Take-Two Interactive (TTWO) had an operating margin of 15.8% in fiscal 2017, with a net margin of 3.5%. Analysts expect TTWO to post a net margin of 9.2% in fiscal 2018, 16.4% in fiscal 2019, and 12.8% in fiscal 2020. Its operating margin could reach 23% in 2018, 25.6% in 2019, and 26.8% in 2020.

Zynga

Zynga (ZNGA) had an operating margin of 2.3% in fiscal 2016, with a net margin of -14.3%. Analysts expect Zynga to post a net margin of 3.3% in fiscal 2017, 7% in fiscal 2018, and 7.7% in fiscal 2019. Its operating margin could reach 12.3% in 2017, 15.2% in 2018, and 19.8% in 2019.