Where Are Miners’ Correlations with Gold Headed?

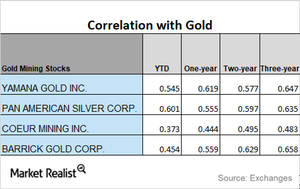

In this article, we’ll aim to study the correlations of Yamana Gold (AUY), Pan American Silver (PAAS), Coeur Mining (CDE), and Barrick Gold (ABX) with gold.

Dec. 19 2017, Published 10:52 a.m. ET

Miners’ correlations with gold

Gold is the most important precious metal, and miners often follow the trends in gold. In this article, we’ll aim to study the correlations of Yamana Gold (AUY), Pan American Silver (PAAS), Coeur Mining (CDE), and Barrick Gold (ABX) with gold.

The prices of mining-based funds are closely related to precious metals prices. The Sprott Gold Miners ETF (SGDM) and the iShares MSCI Global Gold Miners ETF (RING) have risen 4.8% and 4.6%, respectively, on a trailing-five-day basis. The rebound has mainly been due to price increases following the Fed’s recent meeting.

Reading the trends

Among the four miners we’re examining, Pan American has had the highest correlation with gold this year, while Coeur Mining has had the lowest correlation. Barrick and Pan American have seen their correlations with gold fall over the past three years, while Yamana and Coeur Mining have seen mixed trends in their correlations with gold.

Pan American’s three-year correlation with gold is 0.64, and its one-year correlation has fallen to 0.56. A correlation of 0.56 suggests that about 56% of the time, Pan American has moved in the same direction as gold over the past year.

Most miners’ correlations have fallen as of late. Miners are often known to be more volatile than gold. Precious metals’ lackluster performances also seem to have been plaguing these mining companies.