Analyzing the Consumer Sector’s Performance Last Week

On September 1, General Motors (GM) released its August sales report. In August, US retail sales recorded 275,552 vehicles—7.5% higher YoY.

Sept. 5 2017, Published 7:58 a.m. ET

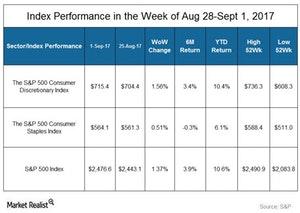

Index performance last week

As of September 1, the S&P 500 Index (10.6%) (SPY) (SPX-Index) has outperformed the S&P 500 Consumer Discretionary Index (10.4%) (XLY) and the S&P 500 Consumer Staples Index (6.1%) (XLP) on a YTD (year-to-date) basis.

Key updates

On September 1, General Motors (GM) released its August sales report. In August, US retail sales recorded 275,552 vehicles—7.5% higher YoY (year-over-year). The company’s commercial sales have risen 19% YoY. General Motors gained domestic commercial market share for 13 consecutive months. Its commercial market share was driven by strong crossover sales at all four of the company’s brands. General Motors stock rose ~5.0% last week.

On September 1, Ford (F) released its sales results for August. The company’s overall sales fell 2.1% to 209,897 vehicles in August. It was mainly impacted by lower fleet sales, which fell 0.2%. Ford’s retail sales for August fell 2.7% to 164,067 vehicles. Its stock rose ~5.0% in the week ending September 1.

L Brands (LB) released its August 2017 sales report on August 31. Its net sales for the four weeks ending August 26, 2017, fell 1.0% YoY to $842.1 million. Its comparable sales also fell 4.0% in August. The company’s exit from the swim and apparel categories impacted comparable store sales for Victoria’s Secret by three percentage points and overall sales by two percentage points. As of September 1, the stock rose 2.4% last week.