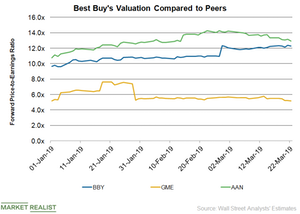

How Best Buy’s Valuation Compares with Peers’

As of March 22, Best Buy’s (BBY) 12-month forward PE ratio was 12.3x, while specialty retail peers GameStop (GME) and Aaron’s (AAN) had PE ratios of 5.2x and 12.9x, respectively.

March 25 2019, Updated 11:58 a.m. ET

Comparing Best Buy’s valuation with peers’

As of March 22, Best Buy’s (BBY) 12-month forward PE ratio was 12.3x, while specialty retail peers GameStop (GME) and Aaron’s (AAN) had PE ratios of 5.2x and 12.9x, respectively. Best Buy’s valuation multiple has risen 12.2% since the company announced its fiscal 2019 fourth-quarter results and gave a strong outlook for fiscal 2020 in February.

Growth prospects

Best Buy has survived a tough retail market over the past several years, with several peers filing for bankruptcy. Online retailers such as Amazon (AMZN) have disrupted the consumer electronics market significantly, grabbing market share from traditional brick-and-mortar retailers.

In fiscal 2020,[1.ending February 1, 2020] Best Buy expects its revenue to rise YoY (year-over-year) to $42.9 billion–$43.9 billion from $42.9 billion. Analysts expect its revenue to rise 1.5% YoY to $43.5 billion.

Best Buy expects its adjusted EPS to rise YoY to $5.45–$5.65 from $5.32, while analysts expect the company’s adjusted EPS to grow 6.2% YoY to $5.65.

The Best Buy 2020 strategy is expected to boost the company’s top line further, and Sears’s bankruptcy and JCPenney’s (JCP) decision to move out of the appliance category are expected to boost Best Buy’s consumer traffic.

In fiscal 2019, Best Buy returned $2.0 billion to shareholders, comprising $1.5 billion as share repurchases and $497 million as dividends. Last month, Best Buy announced an 11% hike in its quarterly dividend per share to $0.50. As of March 22, Best Buy’s dividend yield was 2.9%. Best Buy plans to make share repurchases of $750 million–$1.0 billion in fiscal 2020. Given the company’s improved growth prospects and dividend growth, it is well positioned to attract investors’ attention.