Analyzing Visa’s Assets and Liabilities

As of September 30, 2016, Visa (V) has reported a total asset balance of $64.03 billion. As of June 30, 2017, the company managed to report a total asset balance of $64.00 billion.

Sept. 25 2017, Updated 7:41 a.m. ET

Marginal decline

As of September 30, 2016, Visa (V) has reported a total asset balance of $64.03 billion. As of June 30, 2017, the company managed to report a total asset balance of $64.00 billion. However, the company posted total current assets of $14.31 billion as of September 30, 2016, and $15.71 billion as of June 30, 2017. This rise in total current assets was mainly due to total cash and cash equivalents.

Visa reported total cash and cash equivalents of $5.61 billion as of September 30, 2016, and $7.43 billion as of June 30, 2017.

Visa’s liabilities, excluding equity

Coming to Visa’s liabilities, the company reported total liabilities (excluding equity) of $31.12 billion as of September 30, 2016, and $32.05 billion as of June 30, 2017. This rise was mainly due to the company’s deferred tax liabilities. As of September 30, 2016, the company reported deferred tax liabilities of $4.80 billion and as of June 30, 2017, the company reported deferred tax liabilities amounting to $5.88 billion.

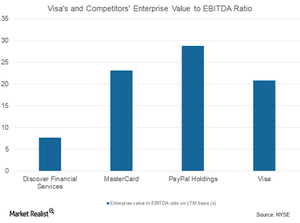

Enterprise value to EBITDA ratio

Over the last 12 months, or on an LTM basis, Visa (V) reported an enterprise value to earnings before interest, tax, depreciation, and amortization or EBITDA ratio of 20.79x. Other consumer financial players (XLF) reported the following enterprise value to EBITDA ratios on an LTM basis.

In the next part of this series, we’ll look at Visa’s premium valuations.