The Directional Correlation Move of Mining Stocks in 2017

If we look at the one-year correlation of miners, Barrick Gold has the lowest correlation with gold, while Yamana has the highest.

Nov. 21 2017, Updated 12:58 p.m. ET

Correlation analysis

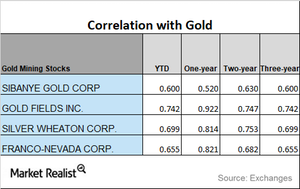

Gold is the most dominant among precious metals. It also has a substantial influence on mining companies. When investors are considering putting their money in mining shares, it’s important to first analyze the correlation of gold to miners.

Below, we’ll assess Yamana Gold (AUY), Pan American Silver (PAAS), Coeur Mining (CDE), and Barrick Gold (ABX) and their correlations to gold. Among the mining funds that have a strong correlation with gold are the Global X Silver Miners ETF (SIL) and the iShares MSCI Global Gold Miners (RING). These two funds have seen five-day trailing losses of 2.6% and 0.99%, respectively.

Trend analysis

If we look at the one-year correlation of miners, Barrick Gold has the lowest correlation with gold, while Yamana has the highest.

Among the four miners we’re analyzing, only Yamana Gold has seen an upward trend in its correlation with gold. Its correlation has risen from a three-year correlation of 0.71 to a one-year correlation of 0.91. Barrick Gold has seen a downward trend in its correlation to gold during the past three years.

Remember, a rise in correlation indicates that price changes in gold should play a role in the stock prices of mining stocks.

A correlation of 0.91 suggests that in the past year, Yamana Gold has been taking cues from gold ~91% of the time. It means that a rise in gold leads to an increase in Yamana Gold ~91% of the time.