What Led to the Recent Rebound in Precious Metals?

After a substantial slump on Monday, gold futures for December delivery rose 0.5% on Tuesday and closed at $1,281.7 per ounce.

Nov. 23 2017, Published 5:10 p.m. ET

Rebound for metals

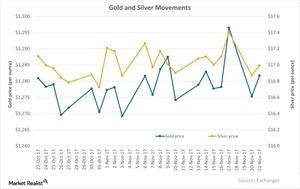

After a substantial slump on Monday, gold futures for December delivery rose 0.5% on Tuesday and closed at $1,281.7 per ounce. Gold was down almost 1.4% on Monday, which was the biggest one-day fall for the metal since September 11. Silver futures for January delivery rose 0.71% to end at approximately $17 per ounce. Platinum for December delivery rose 1.6% and ended the day at $936.4 per ounce, and palladium rose 1.1% to end at $996.5 per ounce.

The rebound in gold was also due to the fall in the US dollar, depicted here by the DXY Index. The DXY Index fell 0.14%, maintaining the inverse relationship between the two. German political uncertainty continued to pressure the euro.

Geopolitical tensions

Besides the movement in the US dollar, major geopolitical risks can also have a substantial impact on precious metals. President Donald Trump has put North Korea back on a list of state sponsors of terrorism. The markets could expect North Korea to react to this move, and it could also escalate global tensions.

Precious metals often react positively to unrest in the market, and gold could rise. In October, the continuous threat from North Korea offered considerable buoyancy to gold and funds like Physical Swiss Gold Shares (SGOL) and SPDR Gold Shares (GLD). These two funds have year-to-date gains of 10.9% each.

Among the mining stocks that also recorded a year-to-date gain are Agnico-Eagle Gold Mines (AEM), Sibanye Gold (SBGL), Gold Fields (GFI), and Kinross Gold (KGC).