Are Wall Street Analysts Bullish on Targa Resources?

On March 23, 2018, Morgan Stanley cut its target price for Targa Resources (TRGP) from $53 to $51.

March 30 2018, Updated 9:03 a.m. ET

Analysts’ recommendations for TRGP

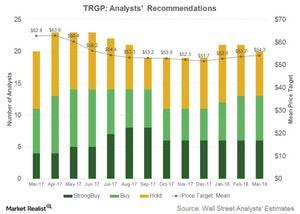

On March 23, 2018, Morgan Stanley cut its target price for Targa Resources (TRGP) from $53 to $51. Of the analysts surveyed by Reuters, 65% rate Targa Resources as a “buy.” Out of these, 30% rated TRGP as “strong buy.” 35% of analysts rated Targa Resources as a “hold.” None of the surveyed analysts rated TRGP as a “sell.”

The mean price target for Targa Resources provided by the surveyed analysts was $54.3. If TRGP attains this price in a year, it would mean an upside of 19% from its current price of $45.46. The above graph shows changes in recommendations for TRGP over the last 12 months.

Peer ratings

Compared to 65% “buy” recommendations for Targa Resources, 57% of the surveyed analysts rated Kinder Morgan (KMI) as a “buy,” half of the surveyed analysts rated ONEOK (OKE) as a “buy,” and all of the analysts rated Enterprise Products Partners (EPD) as a “buy.”

The mean target price provided by the surveyed analysts for Kinder Morgan is $22. If KMI attains its price target in a year, it would imply an upside of 46.0% from its current price of $15.09.

Enterprise Products Partners’ mean price target is $31.80, and it’s trading at $24.23. If EPD attains its mean price target in a year, it would imply an upside of 31.0%.

The mean price target for ONEOK provided by analysts is $64.1. Its stock is currently trading at $56.96. If OKE attains its mean price target in a year, it would mean an upside of 13%.

Learn how MLPs fared last week in MLP Weekly Roundup: Week Ending March 23.