What Were GoPro’s Metrics in 4Q16?

According to NPD Group’s retail tracking service, GoPro (GPRO) accounted for three out of the top five products—including the top two positions—on a unit basis in the US Digital Imaging Product segment for 4Q16.

Feb. 10 2017, Updated 7:36 a.m. ET

GoPro continues leadership in North America and Europe

According to NPD Group’s retail tracking service, GoPro (GPRO) accounted for three out of the top five products—including the top two positions—on a unit basis in the US Digital Imaging Product segment for 4Q16. NPD noted that GoPro’s 4Q16 unit share in the US rose 4% YoY (year-over-year) to 26.7%.

Market research firm GfK stated that GoPro’s digital imaging unit share in Europe (FEP) rose 100 basis points YoY to 12.2% in 4Q16.

During GoPro’s earnings call, the company’s chief operating officer, Charles Prober, stated, “It’s also worth noting that in Europe HERO5 Black sold through more units in a single quarter than any other GoPro camera ever.”

GoPro’s performance in Asia

A GfK report states that GoPro’s unit share in Japan has almost tripled to 3% in the digital imaging segment. GoPro is also optimistic with respect to sales in China (FXI). In 4Q16, GoPro’s unit sell-through rose 61% YoY in China. Sell-through refers the percentage of units shipped that are actually sold.

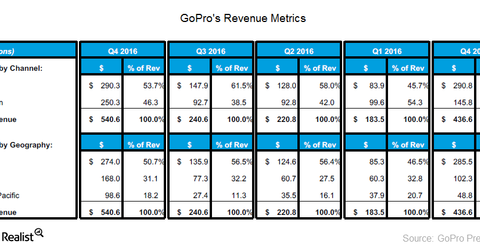

GoPro’s share in Japan’s action camera segment rose 10% YoY to 41% in 3Q16 as well. The US and the Americas accounted for 50.7% of GoPro’s total 4Q16 revenues, followed by Europe at 31% and Asia-Pacific at 18.2%.