Mining Stocks: Analyzing the Technical Details

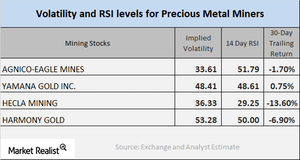

In this part, we’ll concentrate on the technical readings of key mining stocks, including their call implied volatilities and RSI (relative strength index) levels.

Nov. 15 2017, Published 9:24 a.m. ET

Technical indicators

In this final part of the series, we’ll concentrate on the technical readings of key mining stocks, including their call implied volatilities and RSI (relative strength index) levels.

Call implied volatility measures the fluctuations in an asset’s price, given the variations in the price of its call option. The RSI level shows whether a stock is overbought or oversold. An RSI level above 70 suggests that the stock is overbought, while a level below 30 indicates that the stock is oversold.

Volatility and RSI levels

On November 13, 2017, miners Barrick Gold (ABX), Eldorado Gold (EGO), Iamgold (IAG), and Harmony Gold (HMY) had implied volatility readings of 29.1%, 50.4%, 44.3%, and 53.3%, respectively. They had RSI scores of 12.3, 25.4, 54.9, and 65.5, respectively.

During the past 30 trading days, all four of these miners have seen 30-day trailing losses of 16.3%, 48.2%, 6.7%, and 4.3%, respectively.

The past month has also been adverse for most mining shares since precious metals were downward sticky. Even the revival of the US dollar had a significant role in the fall of miners and metals.