How Will HP’s Personal Systems Business Perform in Fiscal 2017?

According to market research company IDC, PC (personal computer) shipments rose marginally by 0.7% YoY (year-over-year) to 70.6 million units in 4Q17.

Feb. 14 2018, Updated 2:15 p.m. ET

PC shipments rose in 4Q17

According to market research company IDC (International Data Corporation), PC (personal computer) shipments rose marginally by 0.7% YoY (year-over-year) to 70.6 million units in 4Q17. Analysts had expected shipments to fall 1.7% in 4Q17. In 2017, shipments fell 0.2% YoY to 259.5 million units. Shipments in the quarter ended December 2017 were driven by commercial upgrades and an increase in commercial demand.

IDC’s report stated, “Although the situation improved as the year progressed, the shortage of key components such as SSD (Solid State Drives) acted as a major driver of shipments for much of 2017, with top PC companies vying to lock up supply ahead of price increases and thus boosting orders.”

HP continues to lead the global PC market

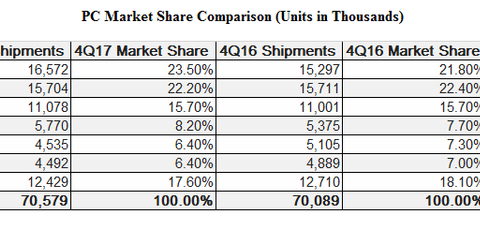

At the end of 4Q17, HP (HPQ) had a market share of 23.5%, up from 21.8% in 4Q16. The company’s shipments rose 8.3% YoY to 16.6 million units, significantly higher than overall market growth. Other top players in the PC space include Lenovo (LNVGY), Dell, Apple (AAPL), ASUS, and Acer Group with shares of 22.2%, 15.7%, 8.2%, 6.4%, and 6.4%, respectively.

Apple’s shipments also rose 7.3% to 5.8 million units in 4Q17, while in 2017, its shipments rose 5.9% to 19.7 million units. Comparatively, unit shipments for HP, Lenovo, and Dell rose 8.2%, -1.2%, and 2.7%, respectively, in 2017.

HP’s number of shipment has grown YoY for seven consecutive quarters now, and its volumes have exceeded 16 million units for the first time since 3Q11.