The Role of Emerging Markets in Global Green Bond Issuance

Over the last ten years, the green bonds (GRNB) universe has expanded and diversified, holding 600 bonds from 24 countries in 23 currencies.

Nov. 20 2020, Updated 2:46 p.m. ET

VanEck

Notable developments

Emerging markets issuers have been notably active this year. Mexico City Airport issued the largest corporate green bond this year. Industrial and Commercial Bank of China (ICBC), the largest commercial bank in the world issued its first green bond this month. Latin American issuance in 2017 has more than doubled compared to 2016 to $7.6 billion.[1. Source: Climate Bonds Initiative] and there has also been a notable uptick in issuance by Indian entities. We believe emerging markets, in general, will play a key role in addressing climate change. There is a significant need to finance the infrastructure required to fuel their growth, but in more sustainable ways than what has been pursued in the past.

New formats of green bonds have also emerged which will help to expand both their issuer and investor bases. For example, the first green sukuk[2. Sukuk commonly refers to the Islamic equivalent of bonds. However, as opposed to conventional bonds, which merely confer ownership of a debt, Sukuk grants the investor a share of an asset, along with the commensurate cash flows and risk. As such, Sukuk securities adhere to Islamic laws sometimes referred to as Shari’ah principles, which prohibit the charging or payment of interest] was issued in July through a partnership between the central bank of Malaysia and the World Bank. Innovative asset-backed green bonds continue to come to market, including the first 100% green residential mortgage-backed security from a Dutch issuer. Sovereign issuance continues to gain attention, with additional countries expected to come to market by the end of the year.

Market Realist

How emerging markets contribute to the green bonds market

Over the last ten years, the green bonds (GRNB) universe has expanded and diversified, holding 600 bonds from 24 countries in 23 currencies. This expansion indicates significant growth in the green bonds market.

According to CBI (Climate Bonds Initiative) data, green bonds issuance comprised 3% of the global bond transactions in 2Q17. Issuers of green bonds are spread across various nations and sectors.

With the growth of the green bonds market, emerging markets’ involvement has also rapidly grown. As of September 2017, emerging markets (VWO) (EMB) accounted for 35% of green bonds issuance since 2016. Cape Town, South Africa, and La Rioja Province, Argentina, issued green bonds this year. The Brazilian Development Bank (or BNDES) issued $1 billion in bonds for renewable (QCLN) energy projects.

The Asian Development Bank (or ADB) issued $47 million in green bonds to develop solar and wind projects in India. The National Bank of Abu Dhabi issued its first green bond worth $587 million.

Nigeria and Kenya are expected to issue sovereign green bonds soon. The Korea Development Bank issued its debut green bond worth $300 billion for renewable energy projects.

China’s involvement in the green bond market is growing deeper. A Reuters report by Claire Milhench stated that China accounted for more than two-thirds of total emerging market green issuance.

China (GXC) is seeing growth in issuance from policy banks. The Agricultural Development Bank of China issued a green bond worth $582 million, and the China Development Bank issued a $1.5 billion bond.[3. Source: Climate Bonds Initiative]

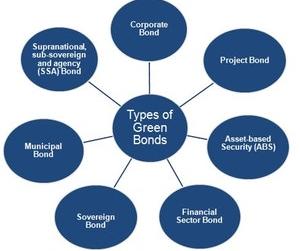

Different types of green bonds

The chart above illustrates seven types of green bonds. However, markets saw new formats when Malaysia’s Tadau Energy introduced and sold the world’s first green Islamic-compliant bond, called sukuk.

In the final part of this series, we’ll see whether more growth can be expected from green bonds this year.