Behind the Technical Details of Key Mining Stocks Today

The Sprott Gold Miners (SGDM) and Global X Silver Miners (SIL) have fallen 0.21% and 1.9%, respectively, on a 30-day-trailing basis.

Nov. 15 2017, Updated 7:32 a.m. ET

Technical reading

When investors start thinking about putting money in precious metals, there are a few important details that they have to watch. Precious metals and miners are not just related to vital market factors like the US dollar, equity market performance, the US dollar. A few other fundamentals matter as well.

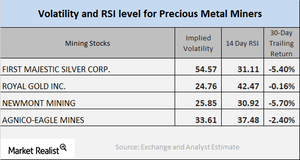

Below, we’ll consider two crucial fundamental indicators: call implied volatility and RSI (relative strength index).

The Sprott Gold Miners (SGDM) and Global X Silver Miners (SIL) have both witnessed declines in their prices over the past month. These two funds have fallen 0.21% and 1.9%, respectively, on a 30-day-trailing basis.

Call implied volatility and RSI

As of November 9, 2017, New Gold (NGD), Newmont Mining (NEM), Franco-Nevada (FNV), and Barrick Gold (ABX) had implied volatilities of 51.3%, 25.9%, 25.5%, and 29.1%, respectively. NGD, NEM, FNV, and ABX now have RSI scores of 36.4, 33.2, 66.1, and 11.1, respectively.

Call implied volatility is used to measure the changes in an asset’s price, given the changes in the price of its call option. RSI tells us whether a stock is overbought or oversold. Levels above 70 suggest that the stock is overbought, while levels below 30 indicate that the stock is oversold.

During the past 30 trading days, the above miners have seen a 30-day trailing loss—except for Franco Nevada. NGD, NEM, and ABX have seen 30-day trailing losses of 13%, 6.3%, and 16%, respectively.

To be sure, the past month was not very good to precious metals, and most mining stocks maintained a downward trend in their prices.