Behind the Correlations of Key Miners Today

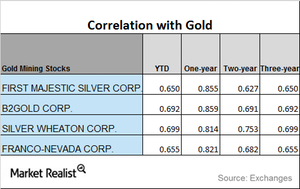

On a YTD (year-to-date) basis, the correlations of the above mining stocks appear to be weak when compared with last year.

Nov. 3 2017, Updated 3:40 p.m. ET

Correlation analysis

When investors want to invest in mining stocks, it’s important that they analyze the correlations of mining stocks with gold. Gold is the most dominant of the precious metals and influences not only fellow metals but also mining stocks. Key mining funds also depend on precious metals for their directional moves.

Below, we’ll assess Yamana Gold (AUY), Pan American Silver (PAAS), AngloGold Ashanti (AU), and Eldorado Gold (EGO). Funds that have a strong correlation with gold and silver include the Global X Silver Miners (SIL) and the iShares MSCI Global Gold Miners (RING).

Correlations with gold

On a YTD (year-to-date) basis, the correlations of the above mining stocks appear to be weak when compared with last year. Among the four miners, Pan American has the lowest correlation with gold, while Yamana has the highest.

These miners—except Pan American—have seen an upward trend in their correlations with gold. Eldorado Gold saw it correlation rise from a three-year correlation of 0.61 to three-year correlation of 0.89.

Remember, a rise in correlation indicates that price changes in gold should actively play a role in mining stocks’ price changes.

A correlation of 0.89 suggests that in the past year, Eldorado has been taking cues from gold ~89.0% of the time. This means that a rise in gold leads to a rise in Eldorado ~89.0% of the time.