Bank of Japan Thinks the Inflation Target Can Be Achieved by 2019

For Japan’s economy, the main struggle has been the low level of inflation. Japan’s inflation has been low for the past three decades.

Nov. 1 2017, Published 10:44 a.m. ET

Japan’s inflation improved

For Japan’s economy, the main struggle has been the low level of inflation. Japan’s inflation has been low for the past three decades. With the Bank of Japan’s efforts through Abenomics or the qualitative and quantitative easing program, the Japanese economy has seen inflation recover.

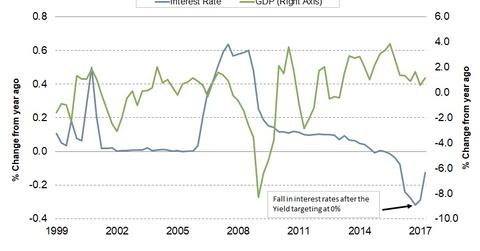

The limits for the qualitative and quantitative easing program were left unchanged at the October meeting. The program targets short-term and medium-term interest rates. The negative interest rate of -0.1% would be maintained for short-term rates. For the medium-term rate, the Bank of Japan will purchase Japanese government bonds to an extent that the yield on ten-year bonds (BNDX) stays near zero percent. Apart from Japanese government bonds (ISHG), the Bank of Japan also purchases ETFs and Japanese real estate investment trusts at a pace of 6 trillion yen and 90 billion yen, respectively.

Bank of Japan’s inflation outlook

In its outlook report, the Bank of Japan said that the inflation rate has been increasing on an annual basis. If the impact of rising oil (USO) prices is factored out, inflation growth remains weak. The Japanese workforce and Japanese companies’ (CAG) rigid mindset forces them to not see wage growth soon. It keeps consumer spending under pressure and companies try to cuts cost by improving productivity.

The average inflation in Japan has been close to 2.5% for almost four decades. Although inflation has picked up from the 2009 low of -2.4%, the Bank of Japan feels there’s a long way to go before inflation reaches its 2% target.

Risks

The Bank of Japan feels that lagging inflation expectations from Japanese firms (HMC) and households in the medium to long term are a key risk to its inflation outlook. The other major risk would be developments in exchange rates and commodity prices, which will have an impact on import and domestic prices.

In the next part of this series, we’ll analyze why Japan’s recent election results are positive for the economy.