A Look at the Trends in Permian Rig Counts

In the latest US rig count report released by Baker Hughes (BHI), the number of active US rigs drilling for oil rose by two to 751 in the week ended December 8, 2017.

Dec. 15 2017, Updated 7:12 a.m. ET

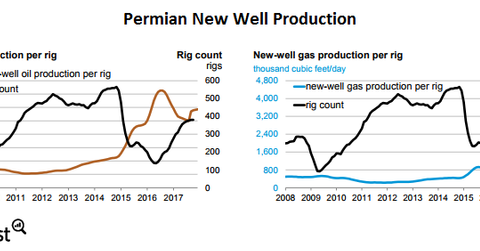

Permian rig counts

In the latest US rig count report released by Baker Hughes (BHI), the number of active US rigs drilling for oil rose by two to 751 in the week ended December 8, 2017, compared to the previous week. There were 498 active oil rigs a year ago.

The US oil rig counts have more than doubled from their 6.5-year low of 316 in May 2016. To know more, read What’s Holding US Crude Oil below $60?

The report noted that as of December 8, 2017, the number of rigs in the Permian Basin was 400. That number represents 43% of the total oil- and natural gas–directed rigs, or 931 rigs operating in the United States.

However, the EIA forecasts that the Permian’s rig count will fall to 345 at the end of 2017 but rise to 370 by the end of 2018.