Why Kellogg’s 3Q17 Profit Margins Could Improve

Kellogg (K) posted improved profit margins despite lower sales, thanks to the company’s focus on efficiency and initiatives to reduce costs.

Oct. 25 2017, Updated 7:38 a.m. ET

Efficiency and cost reductions to boost margins

Kellogg (K) posted improved profit margins despite lower sales, thanks to the company’s focus on efficiency and initiatives to reduce costs. Kellogg’s Project K program and the adoption of zero-based budgeting techniques has helped the company generate higher productivity and cost savings, boosting profit margins

Kellogg’s shift to a warehouse distribution mode from direct store delivery is expected to result in reducing costs and accelerating margin growth.

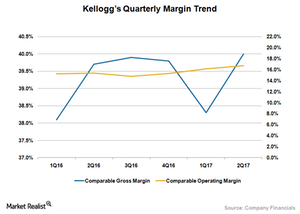

During 2Q17, Kellogg’s gross profit margin improved 30 basis points while its operating margin expanded 130 basis points. Lower input costs, higher productivity savings, and improvement in pricing and mix drove the company’s margin growth.

Among the company’s peers, General Mills (GIS), Kraft Heinz (KHC), and J. M. Smucker (SJM) expect their profit margins to take a hit from volume deleverage and increased input costs. Hershey’s (HSY) 3Q17 margin expansion rate is expected to decelerate due to flat sales and higher commodity costs.

Mondelēz’s 3Q17 margins are projected to benefit from improved volumes, higher pricing, and reduction in overhead and advertising costs. However, rising commodity costs could restrict its margin growth rate.

Outlook

Kellogg’s (K) management remains upbeat with respect to its margins, and it expects productivity and cost-saving measures to drive margins in the coming quarters. Also, its anticipation of improved volumes in 2H17 could support its margin growth.

Kellogg expects its fiscal 2017 operating margins to expand more than 100 basis points. However, sluggish industry trends and increased competitive activity could dent its margins.