Wall Street’s Forecasts for Baker Hughes after Its 4Q17 Earnings

In this article, we’ll look at Wall Street analysts’ forecasts for shares of Baker Hughes, a GE company (BHGE) following its 4Q17 earnings release.

Jan. 26 2018, Updated 7:35 a.m. ET

Wall Street’s forecasts for Baker Hughes

In this article, we’ll look at Wall Street analysts’ forecasts for shares of Baker Hughes, a GE company (BHGE), following its 4Q17 earnings release.

Analysts’ ratings for Baker Hughes

On January 24, 2018, ~39% of the sell-side analysts tracking Baker Hughes rated it as a “buy” or some equivalent. Approximately 55% rated the company as a “hold” or some equivalent. Only 6% of analysts recommended a “sell” or some equivalent on the stock, according to Reuters.

In comparison, ~59% of analysts tracking TechnipFMC (FTI) rated it as a “buy” or some equivalent on January 24. Approximately 29% rated the company as a “hold.”

The energy sector makes up 6.1% of the S&P 500 Index (SPX-INDEX). The S&P 500 Index has risen 23% in the past year compared to the 24% fall in BHGE’s stock price and the 16% fall in the price of the iShares US Oil Equipment & Services ETF (IEZ). Baker Hughes makes up 5.6% of IEZ.

Analysts’ ratings changes for BHGE

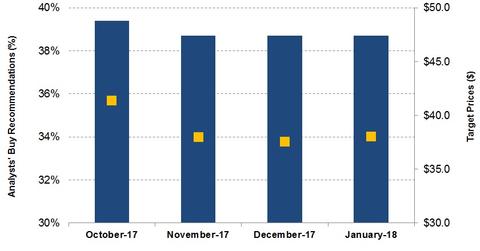

From October 24, 2017, to January 24, 2018, the percentage of analysts recommending a “buy” or some equivalent for BHGE has remained unchanged at 39%. Analysts’ “hold” recommendations have also remained unchanged for BHGE during the same period. A year ago, ~57% of sell-side analysts recommended a “buy” on BHGE.

Analysts’ target prices for BHGE

Wall Street analysts’ mean target price for BHGE on January 24 was ~$38. BHGE is currently trading at ~$33, implying a potential ~14% upside at its current price. A month ago, analysts’ average target price for BHGE was $37.6.

Target prices for BHGE’s peers

Among sell-side analysts, the mean target price for Basic Energy Services (BAS) was $27.6 on January 24. BAS is currently trading at ~$22.3, implying a potential 24% upside at its current price. The mean target price surveyed among sell-side analysts for Weatherford International (WFT) was $5.4 on January 24. WFT is currently trading at ~$4.3, implying a 26% upside at its current price.

Learn more about the OFS industry in Market Realist’s The Oilfield Equipment and Services Industry: A Primer.