Vaccines Business Expected to Boost Sanofi’s Revenues in 2017

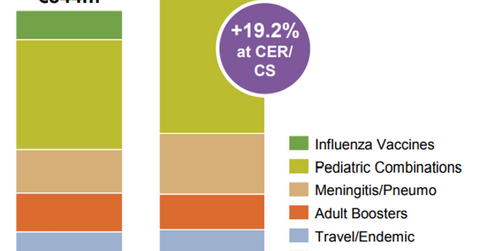

In 2Q17, Sanofi’s (SNY) vaccine business reported revenues of 1.0 billion euros, which is a YoY rise of 26.2% on a CER basis and 19.2% on a CER and CS basis.

Oct. 16 2017, Updated 10:40 a.m. ET

Vaccines business

In 2Q17, Sanofi’s (SNY) vaccine business reported revenues of 1.0 billion euros, which is a YoY (year-over-year) rise of 26.2% on a CER (constant exchange rate) basis and 19.2% on a CER and CS (constant structure) basis. In the first half of 2017, the vaccines business had revenues of 1.8 billion euros, which is a 24.5% YoY rise on a CER basis and a 16.5% YoY rise on a CER and CS basis. The pediatric combination vaccines and meningitis vaccine Menactra have been key growth drivers for Sanofi in 2017. Peers GlaxoSmithKline (GSK), Merck & Co. (MRK), and Johnson & Johnson (JNJ) are also focusing their resources on this growing market opportunity.

Sanofi makes up about 2.8% of the BLDRS Developed Markets 100 ADR ETF’s (ADRD) total portfolio holdings.

Pediatric combination vaccine performance

Sanofi’s PPH (pertussis, polio, and Haemophilus influenzae type B (or Hib)) vaccines include Hexaxim/Hexyon, Pentacel, Pentaxim, and Imovax. The PPH franchise had revenues of 469.0 million euros in 2Q17, which is a YoY rise of 37.2% on a CER basis and 31.4% on a CER and CS basis in 2Q17. In the first half of 2017, the PPH franchise had revenues of 901.0 million euros, which is a YoY rise of 41.3% on a CER basis and 34.4% on a CER and CS basis.

The five-in-one painless Pentaxim vaccine given to infants for protection against tetanus, diphtheria, hepatitis B, pertussis/whooping cough, and Haemophilus influenza Type B was used increasingly in China in 2Q17. Sanofi’s six-in-one painless preservative-free and ready-to-use vaccine for infants, Hexaxim, also witnessed solid demand trends in Europe and certain emerging markets.

Meningitis vaccines

Sanofi’s meningitis/pneumonia vaccines, including Menactra, reported revenues of 195.0 million euros in 2Q17, which is a YoY rise of 38.1% on a CER as well as CS basis. The portfolio reported revenues of 290.0 million euros in the first half of 2017, which is a YoY rise of 8.8% on a CER and CS basis. Menactra benefited due to increased stocking by the Centers for Disease Control and Prevention (or CDC) in the United States, the disease outbreak in Australia, and demand in the Middle East.

In the next part of this series, we’ll look at the performance of Sanofi’s diabetes franchise.