Why US Companies Have Concerns about the Corporate Tax Structure

Among the 35 OECD countries, the US has the highest corporate tax rate of 35%. This tax rate puts US companies at a disadvantage compared to their foreign rivals.

Oct. 17 2017, Updated 3:06 p.m. ET

Tax treatment of foreign earnings

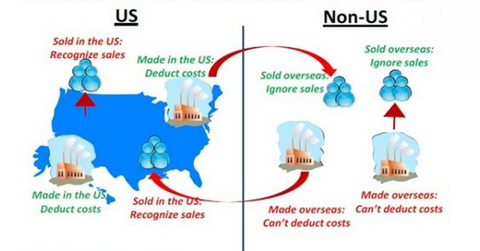

Companies in the US have long been concerned about the tax treatment of foreign earnings, as most companies earn a major portion of their earnings outside the US. They have been concerned that the high corporate tax rate in the US significantly impacts their competitiveness against foreign rivals headquartered in low-tax countries.

Under the current tax policy, a US manufacturer producing goods in other countries pays the local taxes of the foreign country and the US corporate tax, increasing the total tax rate to 35%, or 38.9% including state taxes, according to a Fortune article.

For example, a US manufacturer would pay a 12.5% tax in Ireland and the balance of 22.5% in the US.

How corporate taxes impact US companies’ competitiveness

Among the 35 OECD (Organisation for Economic Cooperation and Development) countries, the US has the highest corporate tax rate of 35%. This tax rate puts US companies at a disadvantage compared to their foreign rivals.

US semiconductor companies such as NVIDIA (NVDA) and Qualcomm (QCOM) are fabless and outsource their manufacturing to foundries in Taiwan and South Korea (EWY). These foundries include TSMC (TSM), Samsung (SSNLF), and Global Foundries. Qualcomm earns more than 94% of its revenues overseas.

On the other hand, 29 OECD countries have a territorial regime under which companies are exempt from the home country’s tax on most or all of their overseas profits. As a result, these companies only pay local taxes in the foreign country. Most European countries levy the home country’s taxes only on passive overseas income such as interest, rent, and royalties.

According to the Fortune article, the Tax Foundation’s director of federal projects, Kyle Pomerleau, stated that US companies want similar tax treatment as the United Kingdom and France. They want a complete exemption on active income earned from manufacturing products overseas.

As the American tax system has not been reformed for 30 years, US multinationals developed with various strategies to reduce their taxes and become more competitive with their foreign rivals. We’ll look into these strategies in the next part of this series.