Reading the Drop in Precious Metals on Monday, October 16

After the rise we saw on Friday, October 13, precious metals had a down day on Monday, October 16.

Oct. 18 2017, Published 12:22 p.m. ET

Monday slump

After the rise we saw on Friday, October 13, precious metals had a down day on Monday, October 16. Gold, silver, platinum, and palladium fell 0.13%, 0.24%, 0.62%, and 0.93%, respectively, on Monday, likely due to the revival of the US dollar.

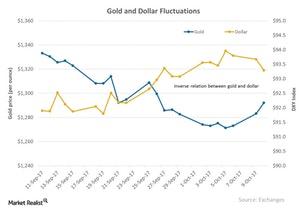

The US dollar, as depicted by the DXY Index, rose 0.24% that day, and gold ended the day at $1,301.2 per ounce. Usually, a rise in the dollar is thought of as negative for precious metals.

A December rate hike?

Many analysts believe that the chance of another interest rate hike in December may be causing this week’s slump in precious metals. According to the CME Fed Watch Tool, markets are now pricing an 82% chance of a rate hike in December meeting—down from 87% before the economic data released on Friday.

Asian stocks also rose on Monday, propelled by the upbeat Chinese data. Remember, any rise in equities can be detrimental for precious metals and mining stocks. Although mining company stocks belong to the equity segment of markets, they closely correlate with the metals these companies mine as well.

Notably, the VanEck Vectors Gold Miners (GDX) fell 1.6% on Monday, and the Global X SIlver Miners (SIL) fell 2.1%. The top-losing mining stock on Monday included B2Gold (BTG), Barrick Gold (ABX), Kinross Gold (KGC), and Eldorado Gold (EGO), which fell 4.7%, 2.6%, 3.4%, and 3.5%, respectively.