Philip Morris Stock Falls on Weak 3Q17 Earnings

Philip Morris International (PM) announced its 3Q17 earnings on October 19. The company posted adjusted EPS (earnings per share) of $1.27 on revenues of $7.47 billion.

Dec. 4 2020, Updated 10:53 a.m. ET

Stock performance

Philip Morris International (PM) announced its 3Q17 earnings on October 19. The company posted adjusted EPS (earnings per share) of $1.27 on revenues of $7.47 billion. Compared to 3Q16, the company’s EPS grew 1.6% while its revenue rose 7.0%.

Stock performance

Analysts were expecting the company to post EPS of $1.38 on revenues of $7.72 billion. The bigger-than-anticipated fall in cigarette shipment volumes in Saudi Arabia and Russia led to lower-than-expected EPS and revenue. Also, expecting the softness in sales to continue, management lowered its guidance to $4.75–$4.80 from the earlier estimate of $4.78–$4.93. The lower-than-expected 3Q17 earnings and lowering of 2017 EPS guidance made investors’ skeptical about Philip Morris’s future earnings, leading to a fall in its stock price. As of October 20, Philip Morris was trading at $109.52, which represents a fall of 2.7% since the announcement of its 3Q17 earnings.

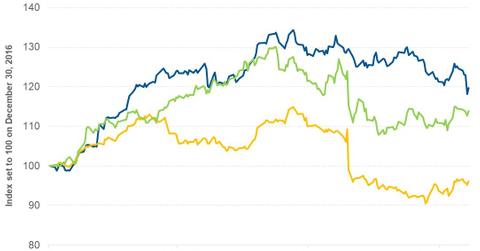

Year-to-date performance

Despite the fall, Philip Morris has returned 19.7% since the beginning of 2017. During that period, its peers Altria Group (MO) and British American Tobacco (BTI) have returned -3.9%, and 13.9%, respectively.

Notably, the broader comparative indices, the Consumer Discretionary Select Sector SPDR Fund (XLY) and the S&P 500 Index (SPX), have returned 12.2%, and 15.0%, year-to-date, respectively.

Series overview

In this series, we’ll look at Philip Morris’s 3Q17 earnings call, compare its 3Q17 performance with analysts’ estimates, and cover management’s guidance for 2017 as well as analysts’ estimates for the next four quarters.

Next, we’ll look at Philip Morris’s revenue in 3Q17.