Kellogg Acquires RXBAR with Eye on Growth

Kellogg (K) announced the acquisition of Chicago Bar Company, the manufacturer of RXBAR, for $600 million.

Nov. 20 2020, Updated 1:12 p.m. ET

Deal details

Kellogg (K) announced the acquisition of Chicago Bar Company, the manufacturer of protein-rich RXBAR, for $600 million. RXBAR will continue to operate as an independent brand after the closure of the deal, which is expected by the end of the current year and is projected to generate about $120 million in sales in 2017.

Why the deal is a strategic fit

As consumers nowadays prefer healthier products, Kellogg’s top line is expected to benefit from the RXBAR addition to its wholesome snacks portfolio. The acquisition is a strategic fit, as RXBAR is a fast-growing nutrition bar brand in the US thanks to its popularity among Millennials. Besides, RXBAR’s diverse distribution channels with a focus on e-commerce further supplement its growth.

Processed food manufacturing companies have turned their focus to the acquisition of fast-growing and in-demand food brands to accelerate sales growth, as demand for their current portfolio remains low.

Recently, Conagra (CAG) announced the acquisition of the Boomchickapop popcorn brand to revamp its portfolio and generate incremental sales. The company earlier acquired Duke’s Meat and BIGS seeds brands, which are growing at a brisk pace and are supplementing its sales. Meanwhile, McCormick (MKC), which has been able to generate industry-leading sales growth despite challenges, is seeing strong growth in its recently acquired brands and estimates it will benefit from these strategic acquisitions in coming quarters.

Also, Campbell Soup (CPB) announced the acquisition of Pacific Foods in July 2017 to realign its portfolio according to consumers’ changing preferences. Moreover, Hershey (HSY) continues to gain from its acquisition of the barkTHINS brand.

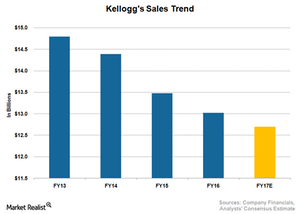

Kellogg is struggling with sales as the graph above shows, especially in the North America region. Management expects its top line to fall 3% in 2017, reflecting sluggish demand and currency headwinds. However, with the focus on fast-growing wholesome foods and the acquisition of RXBAR, Kellogg’s top line could see improvement in the long term.