How the Tokyo Electron Device Deal Fits in Blackberry’s Strategy

Providing Japan with access to Blackberry’s QNX BlackBerry (BB) recently announced that it had entered into a sales and distribution agreement with Japanese semiconductor company Tokyo Electron Device. Under the agreement, Tokyo Electron Device will provide manufacturers in Japan (EWJ) with access to BlackBerry’s QNX Software Development Platform (QNX SDP 7.0). According to BlackBerry, QNX SDP […]

Oct. 26 2017, Updated 5:50 p.m. ET

Providing Japan with access to Blackberry’s QNX

BlackBerry (BB) recently announced that it had entered into a sales and distribution agreement with Japanese semiconductor company Tokyo Electron Device. Under the agreement, Tokyo Electron Device will provide manufacturers in Japan (EWJ) with access to BlackBerry’s QNX Software Development Platform (QNX SDP 7.0). According to BlackBerry, QNX SDP 7.0 is the world’s most advanced and secure embedded platform, providing comprehensive, policy-driven security technology.

Meeting Japan’s stringent security requirements

The technology guards against issues such as system malfunctions, malware, and cybersecurity breaches. QNX SDP 7.0 is suited for medical devices, industrial controllers, high-speed trains, and other safety and mission-critical applications.

“By partnering with BlackBerry QNX, we will be able to offer a platform with capabilities that exceed the stringent reliability, performance and data security requirements that Japan’s world-class manufacturing sector must meet,” said Tokyo Electron Device vice president Yasuo Hatsumi.

A building block for the software business

The QNX deal could be viewed as a building block in BlackBerry’s software and services business. Having lost ground to Apple (AAPL), Samsung (SSNLF), and Chinese (MCHI) brands Huawei and Xiaomi in the smartphone arena, BlackBerry has dedicated efforts and resources towards building its software and services business. According to IDC, Samsung, Apple, Huawei, and Xiaomi were the top five smartphone vendors in 2Q17, commanding global market shares of 23.3%, 12%, 11.3%, and 6.2%, respectively.

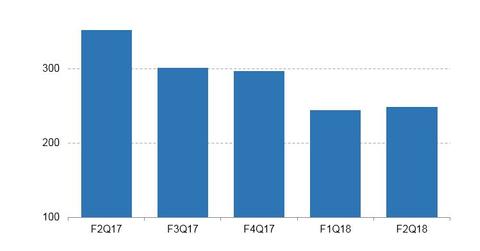

In fiscal 2Q18 (the quarter ended August 2017), BlackBerry reported adjusted revenue of $249 million, up from $244 million in the prior quarter. The sequential revenue increase in fiscal 2Q18 was supported by strong software sales. BlackBerry generated record software sales of $196 million.