How Mining Stocks Are Reacting as of October 17

Despite the overall downturn among precious metals on Tuesday, October 17, precious metal mining stocks witnessed a mixed reaction that day.

Oct. 19 2017, Published 12:18 p.m. ET

Mining stocks

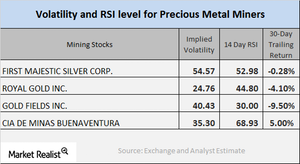

Despite the overall downturn among precious metals on Tuesday, October 17, precious metal mining stocks witnessed a mixed reaction that day. But remember, when analyzing the reaction of mining stocks, we have to read technical details like RSI (relative strength index) and call implied volatility.

Below, we’ll take a look at the volatility figures and RSI levels of Newmont Mining (NEM), Sibanye Gold (SBGL), Silver Wheaton (SLW), and Barrick Gold (ABX).

Miner volatility

Call implied volatility measures the variations in the price of a stock based on the changes in the price of its call option. On October 17, 2017, NEM, SBGL, SLW, and ABX had implied volatilities of 25.9%, 63% 30.8%, and 29.1% respectively. Remember, the volatilities of mining stocks don’t have to be the same as the volatilities of precious metals—the former can be higher.

RSI level

RSI levels help us gauge whether a stock is overbought or oversold. If a stock’s RSI goes higher than 70, it could be overbought, and the price could fall. If a stock’s RSI drops below 30, it’s considered oversold, and the price could increase.

The RSI levels of NEM, SBGL, SLW, and ABX are now 64.7, 75, 69.8, and 49.3, respectively. The recent rebound in these stock prices has led their RSI levels to rise.

Notably, the mining funds also are strongly related to precious metals. The Global X Silver Miners (SIL) and the VanEck Vectors Gold Miners (GDX) have risen 1.9% and 2%, respectively, on a 30-day trailing basis.