How Key Mining Stocks Are Correlated with Gold in October 2017

The PowerShares DB Gold Fund (DGL) and the Vaneck Merk Gold Trust (OUNZ) have risen 12.1% and 12.95, respectively, year-to-date, taking strong cues from gold.

Oct. 18 2017, Updated 9:13 a.m. ET

Correlation study

Understanding the correlations of mining stocks with gold is crucial for investors in precious metal mining stocks. In this part of our series, we’ll assess AngloGold Ashanti (AU), Hecla Mining (HL), Kinross Gold (KGC), and Eldorado Gold (EGO.)

Key mining funds are also strongly dependent on precious metals for their directional moves. Such mining funds include the PowerShares DB Gold Fund (DGL) and the Vaneck Merk Gold Trust (OUNZ), which have risen 12.1% and 12.95, respectively, on a YTD (year-to-date) basis, taking strong cues from gold.

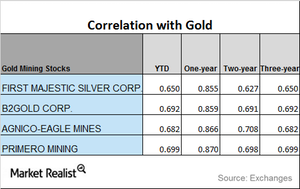

Correlation with gold

On a YTD basis, the correlation of these mining stocks seems to be weak when compared with the previous year. Among the four miners we’re discussing here, AngloGold has the lowest correlation with gold, while Kinross has the highest.

All four mining stocks have an upward trending correlation with gold, however. If we look at Eldorado Gold, its correlation has risen from 0.61 over the past three years to 0.89 over the past year.

Remember, a correlation of 0.89% suggests that over the past year, Eldorado has been taking cues from gold 89% of the time. Otherwise put, a rise in gold leads to a rise in Eldorado ~89% of the time.