How Gold Companies Have Performed in 2017

Gold stock indices also traded near their highs for the year, but then followed the gold price lower. During September the NYSE Arca Gold Miners Index (GDMNTR) retreated 6.5%.

Oct. 30 2017, Updated 11:40 a.m. ET

VanEck

Gold Companies Focusing on Positive Price Trend, Capital Discipline, and Growth

Gold stock indices also traded near their highs for the year, but then followed the gold price lower. During September the NYSE Arca Gold Miners Index (GDMNTR) retreated 6.5%, while the MVIS Global Junior Gold Miners (MVGDXJTR) fell 6.2%. There was little concern over September price weakness at the annual gathering of gold companies and institutional investors at the Precious Metals Summit and Denver Gold Forum. Managements from essentially every gold producer and most gold developers attend these events, and this year the focus was on the longer-term positive price trend. At the Denver Gold Forum, the majors reiterated their commitment to capital discipline and maintaining low costs. We were especially pleased with Newmont Mining’s (4.7% of net assets*) decision to consider raising its dividend yield to approximately 2% (gold stocks generally carry yields well under 1%). It looks like the industry may be gaining the financial strength to offer yields that outperform gold’s 0% yield which may attract more investors.

Many mid-tier companies highlighted growth projects that make this segment of the sector particularly attractive. We expect Iamgold’s (2.9% of net assets*) Saramacca discovery in Surinam to transform their Rosebel Mine from a marginal asset to a core driver of growth and performance. Also, B2Gold (6.2% of net assets*) announced it has commenced processing ore three months ahead of schedule and on budget at its new Fekola Mine in Mali, West Africa. This mine is a transformative asset for B2Gold and is expected to produce 400,000 ounces per year in the first three years at a cost of just $604 per ounce.

Market Realist

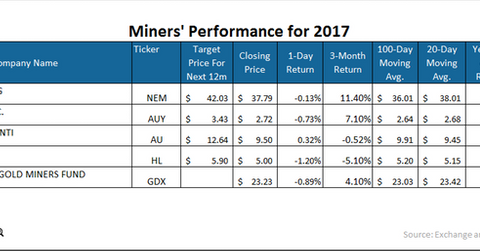

The graph above compares the returns on some mining stocks along with those on the VanEck Vectors Gold Mining ETF (GDX). Newmont Mining (NEM) has almost mirrored the returns on gold (IAU)(OUNZ), rising 10.9% as of October 20. Meanwhile, Yamana Gold (AUY), AngloGold Ashanti (AU), and Hecla Mining (HL) have seen declines of 3.2%, 9.6%, and 4.6%, respectively. The GDX ETF has outperformed all of these stocks year-to-date with returns of 11.0%.

Typically, investors looking for dividends don’t look at gold mining stocks, as we saw above, because not only is mining capital-intensive, but gold miners are also more likely to reinvest than return excess money to shareholders. Miners reinvest in order to make sure they can stay in the green when gold prices turn volatile. Given that tendency, this is a bold move from Newmont Mining to raise its dividend yield.