Which Elements Impact Precious Metals?

Gold fell for the third consecutive day on October 18, 2017, as the US dollar regained strength. However, October 19 was an up day for gold and silver.

Oct. 23 2017, Published 12:21 p.m. ET

Rebound in gold and silver

Gold fell for the third consecutive day on October 18, 2017, as the US dollar regained strength. However, October 19 was an up day for gold and silver. Gold futures for November expiration were 0.54% higher than the previous day and ended at $1,288.1 per ounce. Silver was the winner among the precious metals. Silver rose 1.5% and ended at $17.3 per ounce. In comparison, the platinum and palladium futures for November expiration had a flat day because the expiry is close.

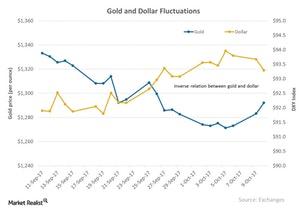

The rise in gold and silver was likely due to the retreat of the DXY Currency Index, which prices the dollar against a basket of six major world currencies. The DXY Index fell 0.22% on Thursday. On a YTD (year-to-date) basis, it has fallen 8.9%.

US dollar

As you can see in the above chart, the US dollar and precious metals, especially gold and silver, have an inverse relationship. As the US dollar’s price rises, more investors would likely deter dollar-based investments. Similarly, a fall in the dollar lures investors to park their money in these dollar-based assets.

Most of the attention in the precious metal market is on the Fed and its decision about the interest rate hike. Higher interest rates are negative for precious metals because metals don’t have intermediary cash flows. The Fed’s decision will likely depend on inflation in the US.

Despite the revival in the price of gold and silver, most miners continued a downward trend. The top losers in the last month are Aurico Gold (AUQ), Primero Mining (PPP), Coeur Mining (CDE), and Harmony Gold (HMY).

Gold and silver-based funds like the Physical Swiss Gold Shares (SGOL) and the Physical Silver Shares (SIVR) have risen 11% and 7.8% YTD, respectively.