Efficient Scale Offers a Narrow Moat

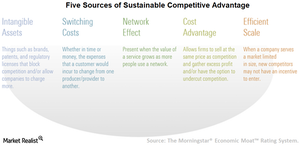

Across the five moat sources (network effect, intangible assets, cost advantage, switching costs, and efficient scale), efficient scale is the most likely to drive a “narrow moat” rating from Morningstar.

Oct. 20 2017, Updated 9:14 a.m. ET

VanEck

Efficient Scale Often Means a “Narrow” Moat

Across the five moat sources (network effect, intangible assets, cost advantage, switching costs, and efficient scale), efficient scale is the most likely to drive a “narrow moat” rating from Morningstar. This rating is driven primarily by utilities companies, many of which warrant a moat rating due to efficient scale but may be limited by heavy government regulation. Returns on invested capital for efficient scale companies tend to be only modestly above capital costs, which makes it difficult to have a high degree of conviction that a company will continually generate minimal economic profit 20 years from now. Efficient scale is, therefore, the least common moat source among “wide moat” rated companies and only slightly more common among all wide and narrow moat-rated companies ahead of only network effect. But, efficient scale can be powerful.

Economic Moat

Market Realist

Efficient scale may not ensure sustainable long-term economic benefits

Though efficient scale provides some advantages to the companies operating in the monopoly market, they typically offer a narrow moat. According to Morningstar, while assigning efficient scale as a source of the economic moat (AMZN)(BIIB), the underlying company has been rated a narrow moat 88% of the time. Morningstar further states that it’s difficult to say that a natural monopoly company will continue to generate sustainable economic profit over a longer period.

Moderate economic profits

Since the ROIC (return on invested capital) generated by an efficient-scale company is only slightly higher than the cost of capital, any changes in the external environment—like regulatory structure, market size, product innovation, and consumer (XLP) tastes—could hurt the company, leading to a decline in economic profit. So the companies (MON)(LOW) operating in natural-monopoly markets are rated as narrow moats that offer very limited economic benefits. Moreover, the entry of new players could lead to a potential loss of efficiency due to the duplication of resources.

As the chart above shows, efficient scale generated an ROIC of at least 7.4% among the five key attributes that can give companies economic moats.