CSX’s 3Q17 Earnings Shine: Higher Freight Rates, Stock Up 2.6%

The eastern US rail freight carrier CSX (CSX) announced its 3Q17 earnings on October 17. The quarter marks the end of two full quarters under the leadership of Hunter Harrison.

Dec. 4 2020, Updated 10:50 a.m. ET

CSX’s 3Q17 earnings

The eastern US rail freight carrier CSX (CSX) announced its 3Q17 earnings on October 17. The quarter marks the end of two full quarters under the leadership of Hunter Harrison.

In the third quarter, CSX missed Thomson Reuters’s earnings estimate by 2.3%. The company’s adjusted EPS (excluding a $1.0 million restructuring charge) was $0.51, whereas analysts had estimated $0.52. On a YoY (year-over-year) basis, CSX’s earnings were 6.3% higher in 3Q17.

Normally, US Class I railroads’ earnings announcements start with CSX. But on the same day, Canadian Pacific Railway (CP) also reported its 3Q17 earnings. The company beat earnings estimates by 20%. It’s reported EPS was 3.5 Canadian dollars, up 50% from 2.34 in 3Q16.

CSX’s stock price reaction

CSX’s operations have been shifting under the Precision Schedule railroading brought in by CEO Hunter Harrison. In this process, the company lost a fraction of its freight volumes to competitor Norfolk Southern (NSC). On the 3Q17 earnings call, Harrison assured investors about the company’s ability to bring back lost customers.

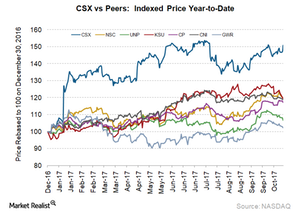

On October 17, markets reacted positively to the operational changes, taking CSX’s stock up 2.6% to close at $54.2. Since the beginning of 2017, CSX has added 51% value to investors. Here’s how peer stocks reacted after CSX’s earnings on October 17.

- Norfolk Southern (NSC): down 0.25%

- Union Pacific (UNP): down 1.3%

- Kansas City Southern (KSU): down 0.4%

- Canadian National Railway (CNI): down 0.2%.

- Canadian Pacific Railway (KSU): down 0.8%

- Genesee & Wyoming (GWR): down 0.5%

On the same day, the iShares Dow Jones US Industrial ETF (IYJ) also fell marginally, by 0.3%.

In this series

In this series, we’ll assess the segmental performance of CSX’s 3Q17 earnings. We’ll go through the word on Wall Street about the company after its 3Q17 earnings. We’ll finish with company valuations along with valuations for other major US railroad stocks.