A Technical Analysis of Mining Shares in October

When investors look at mining stocks, it’s important that they do a technical analysis of the stocks.

Oct. 27 2017, Published 12:07 p.m. ET

Technical analysis of mining shares

When investors look at mining stocks, it’s important that they do a technical analysis of the stocks. In this part of the series, we’ll look at the RSI (relative strength index) levels and call implied volatilities of some select mining stocks.

Call implied volatility is used to measure the fluctuations in an asset’s price, given the variations in the price of its call option. The RSI indicates whether a stock is overpriced or underpriced. Levels above 70 suggest that it’s overbought, and levels below 30 suggest that it’s oversold.

The Merk Gold ETF (OUNZ) and the PowerShares DB Gold ETF (DGL) have risen 10.6% and 9.9%, respectively, on a YTD (year-to-date) basis.

Call implied volatility and RSI level

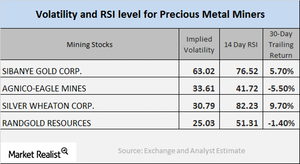

As of October 25, 2017, New Gold (NGD), Sibanye Gold (SBGL), Gold Fields (GFI), and Agnico-Eagle Mines (AEM) had implied volatility readings of 51.3%, 63.0%, 40.4%, and 33.6%, respectively.

The above mining shares’ RSI levels have recovered recently. New Gold, Sibanye, Gold Fields, and Agnico-Eagle Mines have RSI scores of 32.6, 68.8, 29.6, and 38.9, respectively.

If we look at the performance of these stocks over the past 30 trading days, all of them except Sibanye have 30-day trailing losses. The past month has also been negative for precious metals since the dollar has been scaling and news of a possible interest rate hike has caught investors’ attention.