Would Markets Be Prepared for a Central Bank Surprise?

Three central banks on a path to tightening After years of ultra-loose monetary policy, global markets are beginning to realize they may have to wave goodbye to easy money. In their efforts to save the global system from the 2007 financial crisis, and to revive economic growth, US, EU, UK, and Japanese central banks resorted […]

Sept. 29 2017, Updated 9:15 a.m. ET

Three central banks on a path to tightening

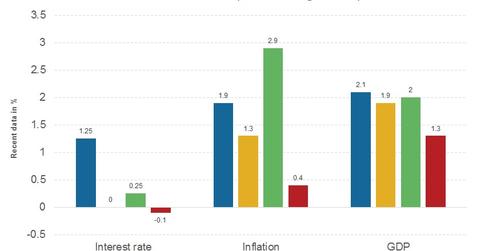

After years of ultra-loose monetary policy, global markets are beginning to realize they may have to wave goodbye to easy money. In their efforts to save the global system from the 2007 financial crisis, and to revive economic growth, US, EU, UK, and Japanese central banks resorted to unconventional monetary policy measures. Central banks flushed the financial system with excess liquidity by lowering real interest rates to close to 0%, and started purchasing bonds to keep the interest rates near zero. After a decade of such measures and as economies are slowly getting back into shape, these central banks have begun gradually tightening their policy.

Are central banks moving ahead of the curve?

The main objective of any central bank is to maintain price stability and a lower unemployment rate in the economy. Unemployment levels in these economies, with the exception of Europe (VGK), have fallen to acceptable levels, but inflation (VTIP) continues to remain stubbornly low. These central banks’ calculated and gradual exit steps are necessary to maintain stability in the economy and will prevent economies from overheating when inflation (TIP) rises too quickly. Returning to a normal policy will enable central banks to use regular monetary policy tools when required.

Are markets prepared for this exit?

Financial markets are accustomed to central banks preparing them for any policy changes, and demand an explanation from these central banks for any such actions. This undocumented agreement has curbed volatility (VXX). However, in a rapidly changing macroeconomic climate, could this understanding continue?

The Bank of Canada’s recent rate hike may serve as an example. There was no warning nor post-hike press conference, and the bank’s surprise created significant volatility in the nation’s equity and currency (FXC) markets. Similarly, there is still uncertainty about another rate hike by the US Fed this year, whether the European Central Bank will remove stimulus in January 2018, and whether the Bank of England will raise interest rates next month. In the next part of this series, we’ll discuss political and fiscal uncertainties in US markets.