Where Cheniere Energy Could Trade in the Next 7 Days

Cheniere Energy’s (LNG) 30-day implied volatility was 27.9% on January 18, 2018, which is slightly higher than its 15-day average of 27.8%.

Jan. 22 2018, Updated 12:25 p.m. ET

Cheniere Energy’s implied volatility

Cheniere Energy’s (LNG) 30-day implied volatility was 27.9% on January 18, 2018, which is slightly higher than its 15-day average of 27.8%. By comparison, peers Kinder Morgan (KMI) and Energy Transfer Equity (ETE) have implied volatilities of 21.5% and 30.6%, respectively.

The Alerian MLP ETF (AMLP) has an implied volatility of 21.3%. Cheniere Energy’s higher implied volatility compared to AMLP could be attributed the volatility in LNG (liquefied natural gas) prices. Any fluctuation in LNG prices impact earnings of Cheniere Marketing.

Cheniere Energy’s price forecast

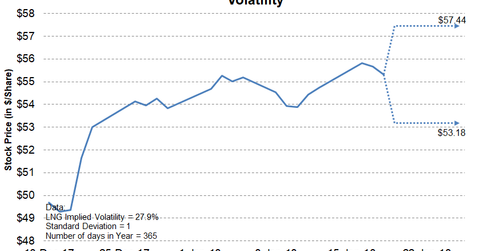

Cheniere Energy is expected to trade in the range of $53.18–$57.44 during the next seven days, based on its closing price of $55.28 on January 18.

Cheniere Energy is expected to trade within this range with a 68.0% probability. This assumes a standard deviation of one and a normal distribution of prices.

In the next part of this seres, we’ll analyze Cheniere Energy’s current valuations.