What Analysts Recommend for Colgate-Palmolive

The majority of analysts providing recommendations on Colgate-Palmolive (CL) stock maintain a neutral outlook.

Sept. 27 2017, Updated 9:11 a.m. ET

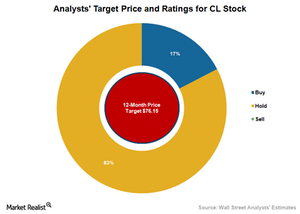

Rating and target price

The majority of analysts providing recommendations on Colgate-Palmolive (CL) stock maintain a neutral outlook. Moderating category growth, increased competition, adverse currency movement, and higher raw material and advertising costs are expected to dent the company’s sales and profitability in coming quarters.

However, favorable comparisons, price restructuring, tight cost control, and growth in emerging markets are likely to drive the company’s financials.

Of the 23 analysts providing ratings on the CL stock, 83% recommended a “hold,” and 17% maintained a “buy.” Meanwhile, analysts have a score of 2.8 on CL stock on a scale of 1.0 (strong buy) to 5.0 (strong sell). Colgate-Palmolive stock closed at $73.00 on September 25, reflecting an upside of 4.3% compared to the analysts’ target price of $76.15.

In comparison, analysts also maintain a neutral outlook on most of the company’s peers including Clorox (CLX), Kimberly-Clark (KMB), Church & Dwight (CHD), and Procter & Gamble (PG).

Valuation summary

Colgate-Palmolive stock was trading at a one-year forward PE multiple of 24.4x on September 25, which is well above the peer group average of 21.1x. Meanwhile, the company’s current valuation is also higher than the S&P 500 (SPX-INDEX), which was trading at a forward PE multiple of 18.1x.

On the same day, Johnson & Johnson (JNJ), Kimberly-Clark, Procter & Gamble, Clorox, and Church & Dwight stock were trading at a forward PE ratio of 17.6x, 18.5x, 22.3x, 23.1x, and 24.3x, respectively.