Xultophy Could Substantially Boost Novo Nordisk’s Revenue Growth

In the first half of 2017, Novo Nordisk’s (NVO) Xultophy generated revenues of DKK (Danish kroner) 284.0 million.

Sept. 21 2017, Updated 9:09 a.m. ET

Xultophy revenue trends

In the first half of 2017, Novo Nordisk’s (NVO) Xultophy generated revenues of DKK (Danish kroner) 284.0 million. Xultophy 100/3.6 is prescribed for reduction of blood sugar levels in individuals with type 2 diabetes who cannot be controlled with lower than 50.0 units of long-acting insulin daily.

Xultophy’s efficacy in clinical trials

In September 2017, Novo Nordisk presented statistical data at the European Association for the Study of Diabetes (or EASD 2017) for Xultophy (insulin degludec/liraglutide). Xultophy demonstrated that diabetic individuals who were treated with the drug had substantially lower total cholesterol, lower systolic blood pressure, and lower low-density lipoprotein (or LDL) cholesterol compared to patients who were treated with insulin glargine U100 or insulin degludec. The statistics were derived from a new post-hoc analysis of two trials with Xultophy. The DUAL II trial evaluated the safety and efficacy of Xultophy compared to insulin degludec, while the DUAL V trial evaluated the safety and efficacy of Xultophy compared to insulin glargine U100. In both trials, patients were on Metformin for 26 weeks. Overall, the two clinical trials and statistical analysis confirmed that Xultophy diminishes the cardiovascular risk factors in individuals with type 2 diabetes.

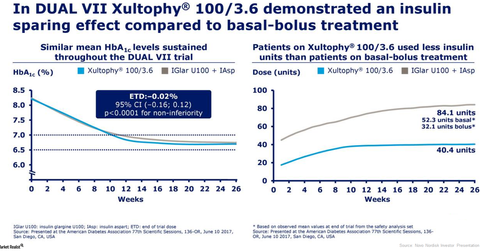

Previously, in December 2016, Novo Nordisk presented results from the Phase 3b DUAL VII trial. In that trial, Xultophy demonstrated that it is non-inferior to insulin glargine U100 in combination with insulin aspart in relation to lowering of HbA1c. Patients on Xultophy as well as insulin glargine groups reached a comparable HbA1c level of 6.7% after 26 weeks of therapy from a mean baseline HbA1c of 8.2%.

At the completion of the DUAL VII trial, patients on Xultophy therapy required 40.1 units of insulin compared to 84.6 units of insulin for patients on insulin glargine U100 in combination with insulin aspart.

Novo Nordisk’s peers in the diabetes care market include Sanofi (SNY), Eli Lilly (LLY), Johnson & Johnson (JNJ), AstraZeneca, and others. The VanEck Vectors Pharmaceutical ETF (PPH) has ~5.7% of its total portfolio in Novo Nordisk.