Analysts’ Latest Recommendations for 3M

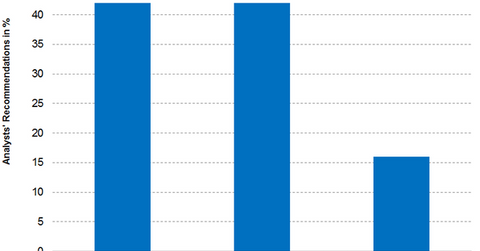

As of March 8, 18 brokerage firms were tracking 3M stock—42% of the analysts rated it as a “buy,” 42% rated it as a “hold,” and 16% rated it as a “sell.”

March 8 2017, Updated 10:37 a.m. ET

Analysts’ recommendation for 3M

As of March 8, 2017, 18 brokerage firms were actively tracking 3M (MMM) stock. Among them, 42% of the analysts recommended the stock as a “buy,” 42% of the analysts recommended the stock as a “hold,” and the remaining 16% of the analysts recommended the stock as a “sell.”

Analysts’ consensus indicates a 12-month target price for 3M at $187.70. It implies a return potential of -0.7%% from its closing price of $189.09 on March 7, 2017.

Why most analysts remained positive

3M posting better-than-expected earnings—primarily due to better operating expenses and 3M reaffirming its fiscal 2017 generally accepted accounting principles EPS guidance range of $8.45–$8.80. It could have caused analysts to remain positive on the stock.

Recommendations and target prices

Below are some of the recommended target prices from well-known brokerage firms for 3M:

- On January 25, 2017, Stifel raised the target price for 3M from $187 to $190. It implies a 12-month return of 0.5% over the closing price as of March 7, 2017.

- On January 18, 2017, Jefferies rated 3M as “buy” with a target price of $210. It implies a 12-month potential return of 11.1%—compared to the closing price of $189.09 on March 7, 2017.

- On January 13, 2017, JPMorgan (JPM) announced 3M’s target price at $186. It implies a 12-month return of -1.60%—compared to the closing price of $189.09 on March 7, 2017.

Investors can indirectly hold 3M by investing in the ProShares Ultra Dow30 (DDM). DDM invested 4.7% of its portfolio in 3M. The fund’s top holdings include Goldman Sachs (GS) and IBM (IBM). They have weights of 6.2% and 4.5% as of March 7, 2017.

In the next part, we’ll look at 3M’s latest valuations.